better banking

Invoice Factoring

Access more capital with full flexibility

How it works

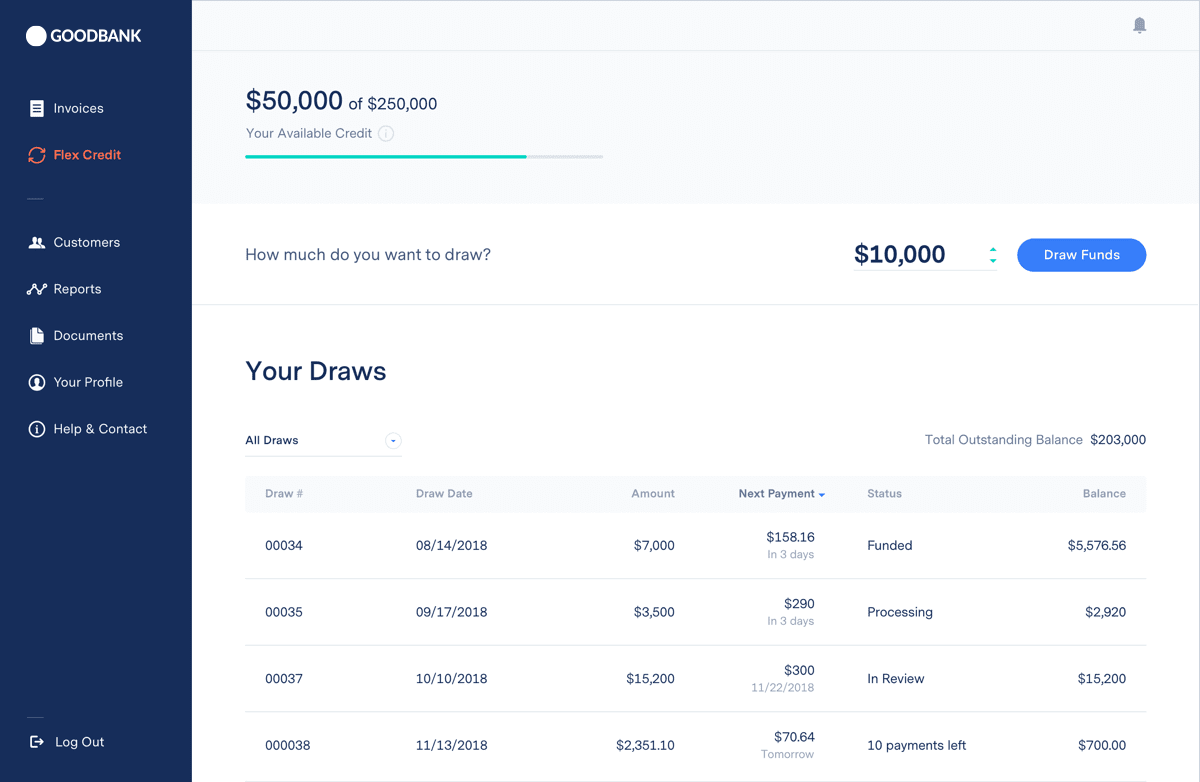

Line of Credit

Fast working capital made simple

How it works

About the paycheck

protection program

The Paycheck Protection Program (PPP) supported small businesses with 100% federally guaranteed loans to overcome obstacles created by the COVID-19 pandemic. Small businesses could apply for up to 2.5x their monthly payroll costs, or more in certain circumstances. A PPP loan had a maturity of 2-5 years, an interest rate of 1.00%, and could function like a grant if businesses met certain forgiveness criteria.

PPP borrowers don’t need to repay their loan if it is forgiven. To be eligible for forgiveness, a PPP borrower has up to 24 weeks from their PPP loan origination date to spend the loan on eligible expenses. At least 60% of the PPP loan must be used to fund payroll and employee benefits costs. The remaining 40% can be spent on certain expenses like mortgage interest payments, rent and lease payments, utilities, and others. If you meet these and other criteria, you’ll be able to have 100% of the loan forgiven.

Small Business Administration (SBA) Lending

Our SBA loan specialists can help you take advantage of the following goverment-backed loan programs.